I’ve been trying to catch up with the comments on the StreetStrategist’s Hyperwage Theory (the theory was published Businessworld and at http://streetstrategist.weblogs.us). I just wanted to reiterate that hyperwages are actually being implemented in the Philippines at present. The Left and many of us say that there is a small elite class in the country that need to share their wealth. I would like to think, however, and as someone once wrote, that there are First World communities even in Third World countries. This is clearly seen when an Inquirer columnist recently wrote about some CEO-Taipans who pay themselves from a low of P3 million up to P25 million a year on company profits of from P1 billion to as much as P7 billion. I would also be curious to find out how much their other managers earn and how and where they reinvest and spend their income. As I wrote months ago, Ayala Land managers buy Ayala Land stocks and properties. Do Metrobank officers buy Metrobank investment instruments? In this scenario, hyperwage is a ‘real physical process’ and needs to be expanded.

How to expand and where? Metro Manila and not East Timor is the best place to do this. Afterall, the Hyperwage theorist is from Metro Manila and has developed a cult of believers, most of whom are professionals and entrepreneurs. This could be the starting point to achieve the critical mass needed. Second, Metro Manila is the ideal setting to implement the theory. It has a large population (12million) and is the country’s financial, commercial, industrial, educational, political, economic, and social center. It is highly urbanized and diverse. It’s residents have the intellectual and economic status to implement something this radical, yet simple. It is also strategically located to national, regional, and international markets.

Lastly, the biggest domestic market is Metro Manila. With its population, the Keynes multiplier effect could easily occur, be observed, and measured.

What I take away from the many postings and from what I have been reading elsewhere is this: the world is in flux and many areas of the world are in systemic crisis. Being currently based in the U.S., I see the present Bush Administration overseeing a radical overhauling of the economy based on minimizing welfare (social services spending), lowering corporate and personal income taxes (for the top 3%), and unregulated free trade. Wal-Mart, with 2005 sales of only $314 Billion, has initiated a “race to the bottom” in terms of consumer prices and living wages. The Wal-Mart business model seems to be depressing wages, de-industrializing the U.S. (the emphasis on cost efficiency has forced many U.S. firms to relocate to China) and gutting jobs, and eventually lowering the living standards of middle class America. As a petrochemical industry briefing noted, their top three clients are: (1) China, (2) Wal-Mart, and (3) the rest of the world.

The flipside of this is the rise of what is called base-of-pyramid (BOP) initiatives. Because of dim employment prospects, the poor are being encouraged and assisted to enter into entrepreneurial activities. Tens of thousands (no exaggeration) of community organizations, NGOs, and fair-trade activists have organized commercial firms trading (fairly) everything from shade-grown coffee to solar cookers. These are social movements addressing the ill effects of brutal free trade by defining and operationalizing fair trade, e.g. market economy with a heart.

The other trend I’ve been reading about is the growth of the underground economy and of illegal activities. Eric Schlosser’s second book, Reefer Madness: Sex, Drugs, and Cheap Labor in the American Black Market (Houghton Mifflin 2003) writes that the confluence of a moralistic-legalistic government, technological advances, and the huge profits that can be made in the burgeoning black market, have made illegal activities rival the mainstream economy in terms of size. Neo-classical economics has not accounted for this.

Thus, while one critic correctly writes about the conspiratorial activities of the U.S.-EU-World Bank-IMF-global financial capitalists; individuals, communities, and states still have agency. They can still act, react, mobilize, and strive to counter the effects of economic injustice (the “structure”). Schlosser uses the term “brittle” to describe the unsustainability of the law enforcement framework based on a moralistic and self-serving agenda. When a society is brittle it is vulnerable. Notice how the top officials in the Bush administration are being indicted one by one or are under a cloud of suspicion. Brittle.

How do all these relate to Hyperwages in the Philippines? If the Bush Administration is successful it will continue facilitating the “race to the bottom” China/Wal-Mart strategy with its adverse effects on the middle class. That will affect the 2.5 million Fil-Ams. The outsourcing of U.S. industrial jobs mostly went to China. This was a missed opportunity on our part. Last year, I attended this talk on the effect of NAFTA on the Mexican economy. The speaker observed that NAFTA has resulted in a net loss of Mexican jobs (despite the 4,000 maquiladores or foreign-funded factories on the U.S.-Mexico border region reportedly paying an average $5/day) and the de-industrialization of Mexico. It has also increased the Mexican diaspora to the U.S.

Last year, I attended this talk on the effect of NAFTA on the Mexican economy. The speaker observed that NAFTA has resulted in a net loss of Mexican jobs (despite the 4,000 maquiladores or foreign-funded factories on the U.S.-Mexico border region reportedly paying an average $5/day) and the de-industrialization of Mexico. It has also increased the Mexican diaspora to the U.S.

How to expand and where? Metro Manila and not East Timor is the best place to do this. Afterall, the Hyperwage theorist is from Metro Manila and has developed a cult of believers, most of whom are professionals and entrepreneurs. This could be the starting point to achieve the critical mass needed. Second, Metro Manila is the ideal setting to implement the theory. It has a large population (12million) and is the country’s financial, commercial, industrial, educational, political, economic, and social center. It is highly urbanized and diverse. It’s residents have the intellectual and economic status to implement something this radical, yet simple. It is also strategically located to national, regional, and international markets.

Lastly, the biggest domestic market is Metro Manila. With its population, the Keynes multiplier effect could easily occur, be observed, and measured.

What I take away from the many postings and from what I have been reading elsewhere is this: the world is in flux and many areas of the world are in systemic crisis. Being currently based in the U.S., I see the present Bush Administration overseeing a radical overhauling of the economy based on minimizing welfare (social services spending), lowering corporate and personal income taxes (for the top 3%), and unregulated free trade. Wal-Mart, with 2005 sales of only $314 Billion, has initiated a “race to the bottom” in terms of consumer prices and living wages. The Wal-Mart business model seems to be depressing wages, de-industrializing the U.S. (the emphasis on cost efficiency has forced many U.S. firms to relocate to China) and gutting jobs, and eventually lowering the living standards of middle class America. As a petrochemical industry briefing noted, their top three clients are: (1) China, (2) Wal-Mart, and (3) the rest of the world.

The flipside of this is the rise of what is called base-of-pyramid (BOP) initiatives. Because of dim employment prospects, the poor are being encouraged and assisted to enter into entrepreneurial activities. Tens of thousands (no exaggeration) of community organizations, NGOs, and fair-trade activists have organized commercial firms trading (fairly) everything from shade-grown coffee to solar cookers. These are social movements addressing the ill effects of brutal free trade by defining and operationalizing fair trade, e.g. market economy with a heart.

The other trend I’ve been reading about is the growth of the underground economy and of illegal activities. Eric Schlosser’s second book, Reefer Madness: Sex, Drugs, and Cheap Labor in the American Black Market (Houghton Mifflin 2003) writes that the confluence of a moralistic-legalistic government, technological advances, and the huge profits that can be made in the burgeoning black market, have made illegal activities rival the mainstream economy in terms of size. Neo-classical economics has not accounted for this.

Thus, while one critic correctly writes about the conspiratorial activities of the U.S.-EU-World Bank-IMF-global financial capitalists; individuals, communities, and states still have agency. They can still act, react, mobilize, and strive to counter the effects of economic injustice (the “structure”). Schlosser uses the term “brittle” to describe the unsustainability of the law enforcement framework based on a moralistic and self-serving agenda. When a society is brittle it is vulnerable. Notice how the top officials in the Bush administration are being indicted one by one or are under a cloud of suspicion. Brittle.

How do all these relate to Hyperwages in the Philippines? If the Bush Administration is successful it will continue facilitating the “race to the bottom” China/Wal-Mart strategy with its adverse effects on the middle class. That will affect the 2.5 million Fil-Ams. The outsourcing of U.S. industrial jobs mostly went to China. This was a missed opportunity on our part.

Last year, I attended this talk on the effect of NAFTA on the Mexican economy. The speaker observed that NAFTA has resulted in a net loss of Mexican jobs (despite the 4,000 maquiladores or foreign-funded factories on the U.S.-Mexico border region reportedly paying an average $5/day) and the de-industrialization of Mexico. It has also increased the Mexican diaspora to the U.S.

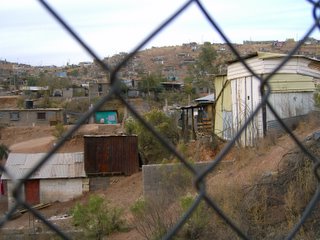

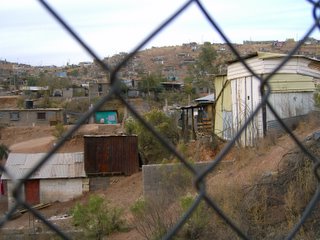

Last year, I attended this talk on the effect of NAFTA on the Mexican economy. The speaker observed that NAFTA has resulted in a net loss of Mexican jobs (despite the 4,000 maquiladores or foreign-funded factories on the U.S.-Mexico border region reportedly paying an average $5/day) and the de-industrialization of Mexico. It has also increased the Mexican diaspora to the U.S.(Homes in a colonia in Nogales, Sonora, Mexico, Dec. 2005. Many residents are employed but wages are not enough to afford adequate housing.)

The elite in the Philippines may favor this race to the bottom, but as noted, Philippine society will become brittle. Metro Manila has about 40% of its residents living in squatter settlements. The U.S. embassy alone processes about 500,000 visa applications yearly. Just think, one in eight Filipinos now live abroad. I am not calling for a forced redistribution of wealth, but for Filipinos to have more opportunities to generate wealth for themselves. If not, the economic diaspora will continue and the ones left behind will be the angry poor, the vulnerable, the politicians, and their lackeys.

My last point is this. OFW remittances are reportedly $10 Billion for 2005. Where is this money being invested in? It is usually in real estate, consumer items, and pseudo investment schemes, usually pyramid schemes. This is another disservice to our OFWs. They need to have more investment options. Filipino entrepreneurs need to be more creative and bold and offer something more to OFWs. As one noted, if we had basic industries, then maybe OFW remittances could be a cheaper source of capital.

Living wages are under attack worldwide. This is one of the great intellectual and moral debates at present. How do we, as a society, want to proceed: a race to the bottom ala China/Wal-Mart or through a genuine partnership among different sectors of society to uplift the living standards of ALL Filipinos?

I wouldn’t pin my hopes on the government initiating Hyperwage. I would rather follow the Gawad Kalinga strategy of establishing a track record of private sector initial successes, partnership building, transparency, and accountability so that when the time comes to deal with the government, we deal from a position of equal footing.

We need to be more creative and bold in leveraging our freedom (while we still have it), skills, experience, and network in this pursuit.

My last point is this. OFW remittances are reportedly $10 Billion for 2005. Where is this money being invested in? It is usually in real estate, consumer items, and pseudo investment schemes, usually pyramid schemes. This is another disservice to our OFWs. They need to have more investment options. Filipino entrepreneurs need to be more creative and bold and offer something more to OFWs. As one noted, if we had basic industries, then maybe OFW remittances could be a cheaper source of capital.

Living wages are under attack worldwide. This is one of the great intellectual and moral debates at present. How do we, as a society, want to proceed: a race to the bottom ala China/Wal-Mart or through a genuine partnership among different sectors of society to uplift the living standards of ALL Filipinos?

I wouldn’t pin my hopes on the government initiating Hyperwage. I would rather follow the Gawad Kalinga strategy of establishing a track record of private sector initial successes, partnership building, transparency, and accountability so that when the time comes to deal with the government, we deal from a position of equal footing.

We need to be more creative and bold in leveraging our freedom (while we still have it), skills, experience, and network in this pursuit.

Happy 2006.